by Thomas Oct 18,2025

Several weeks back, Microsoft increased pricing across its entire Xbox Series console lineup globally while confirming select new games would carry an $80 price tag this holiday season. This move trailed similar PlayStation console price hikes in certain markets by a mere week, while Nintendo simultaneously adjusted Switch 2 accessory pricing and unveiled its inaugural $80 title.

The anticipated wave of tariff-driven price increases has materialized, creating a dizzying landscape of escalating costs throughout the gaming ecosystem. To better understand these developments following Xbox's announcement, I consulted industry analysts about the driving forces behind these changes, projected gaming expenses in the coming year, and the broader implications for the video game industry. While the consensus confirms gaming platforms aren't disappearing, the sobering reality is that players face substantially higher costs across the board.

When questioning analysts about Microsoft's significant price adjustments, responses overwhelmingly pointed to tariff impacts. Dr. Serkan Toto, CEO of Kantan Games, noted: "Microsoft's Asian manufacturing base makes these increases inevitable." He praised the company's strategic timing, using the current economic climate to implement global adjustments simultaneously rather than through staggered regional announcements.

Joost van Dreunen, NYU Stern professor and SuperJoost Playlist author, characterized Microsoft's approach as "ripping off the Band-Aid all at once" through a comprehensive pricing strategy addressing hardware, subscriptions, and first-party titles. This coordinated adjustment positions Xbox competitively in an increasingly service-oriented market where hardware serves primarily as an entry point.

Additional expert insights revealed multiple contributing factors:

The analysis suggests Sony will likely follow with PlayStation price adjustments, particularly in the U.S. market. Niko Partners' Daniel Ahmad observed Sony's previous regional increases while noting U.S. market sensitivities. Omdia's James McWhirter pointed to manufacturing vulnerabilities, with PS5 production concentrated in China making Sony particularly tariff-sensitive.

Regarding software pricing, Elliott predicted a broader industry shift: "With Nintendo and Xbox establishing $80 games, every capable publisher will follow. The market will bear it, as evidenced by millions paying premium prices for early access." He anticipates more dynamic pricing strategies post-launch to maximize revenue across different customer segments.

Despite concerns about affordability dampening sales, analysts remain cautiously optimistic about industry resilience:

Circana's Mat Piscatella offered a more tempered perspective, suggesting economic pressures may accelerate shifts toward free-to-play models and existing game libraries. He emphasized unprecedented market uncertainty, stating forecast reliability has significantly diminished amid ongoing economic volatility.

As the industry navigates these turbulent conditions, one reality remains clear: gaming remains a robust entertainment sector, but players should prepare for notably higher costs across hardware, software, and services in the foreseeable future.

"Clair Obscur: Expedition 33 Hits 1 Million Sales in 3 Days"

Top 10 Liam Neeson Films Ranked

Ragnarok V: Returns Beginner's Guide - Classes, Controls, Quests, Gameplay Explained

Roblox Deep Descent: January 2025 Codes Revealed

How to Feed Villagers in Necesse

Bitlife: How to Complete the Renaissance Challenge

"Ōkami 2: Capcom, Kamiya, and Machine Head Discuss Sequel in Exclusive Interview"

Bahiti Hero Guide: Mastering the Epic Marksman in Whiteout Survival

Project TAL: Pre-Orders Open, DLC Detailed

Mar 03,2026

Wartune Ultra: Advanced Gameplay Guide

Feb 23,2026

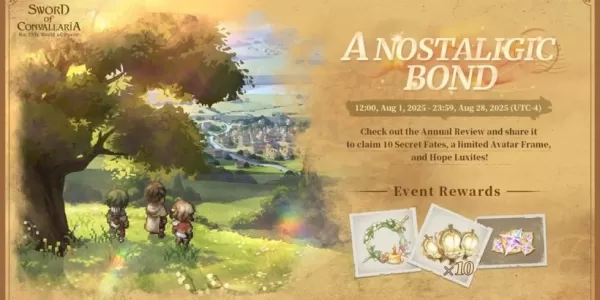

Sword of Convallaria celebrates its first anniversary with a major new update

Feb 22,2026

Batman: Arkham Knight Sequel's Bruce Wayne Concept Revealed

Feb 20,2026

2025's Top Pokémon Card Retailers

Feb 19,2026